The Rise of Retirement-Extended Mortgages: A Growing Concern for Homeowners

In a shifting economic landscape, nearly 40% of new mortgages in the United States are being structured with terms that may last well into the retirement years of borrowers. This trend raises significant concerns about the financial implications for homeowners who may find themselves making mortgage payments long after they have left the workforce. This article explores the motivations behind this phenomenon, its potential consequences, and what it means for future generations of homeowners.

The Current Housing Market Landscape

The housing market has undergone dramatic changes in the past decade, fueled by fluctuating interest rates, increasing home prices, and a rising cost of living. As the demand for housing continues to outpace supply, many prospective homebuyers are opting for longer mortgage terms to make their monthly payments more manageable.

Traditionally, most mortgages were structured with terms of 15 to 30 years. However, in a time when prices are surging, longer-term mortgages, often stretching 30 years or more, have become increasingly common. This shift prompts homeowners to extend the repayment period, thus enabling them to afford homes that might otherwise be out of reach.

Understanding the Trend: Why Borrowers Choose Longer Terms

Several factors contribute to the increasing prevalence of extended mortgages. Firstly, rising home prices mean that many buyers require larger loans to purchase properties that meet their needs. As home values continue to increase, prospective homeowners may feel compelled to take out longer-term mortgages to accommodate their budgets.

Secondly, younger generations—such as millennials and Gen Z—are experiencing a significant burden of student loan debt, coupled with rising costs of living and stagnant wages. As they navigate these financial challenges, acquiring a long-term mortgage can seem like the only viable way to enter the housing market.

Moreover, the flexible nature of 30-year fixed-rate mortgages offers borrowers stability in their monthly payment amounts, particularly in an unpredictable economic environment, allowing them to better plan their finances over the long term.

Implications for Homeowners: A Double-Edged Sword

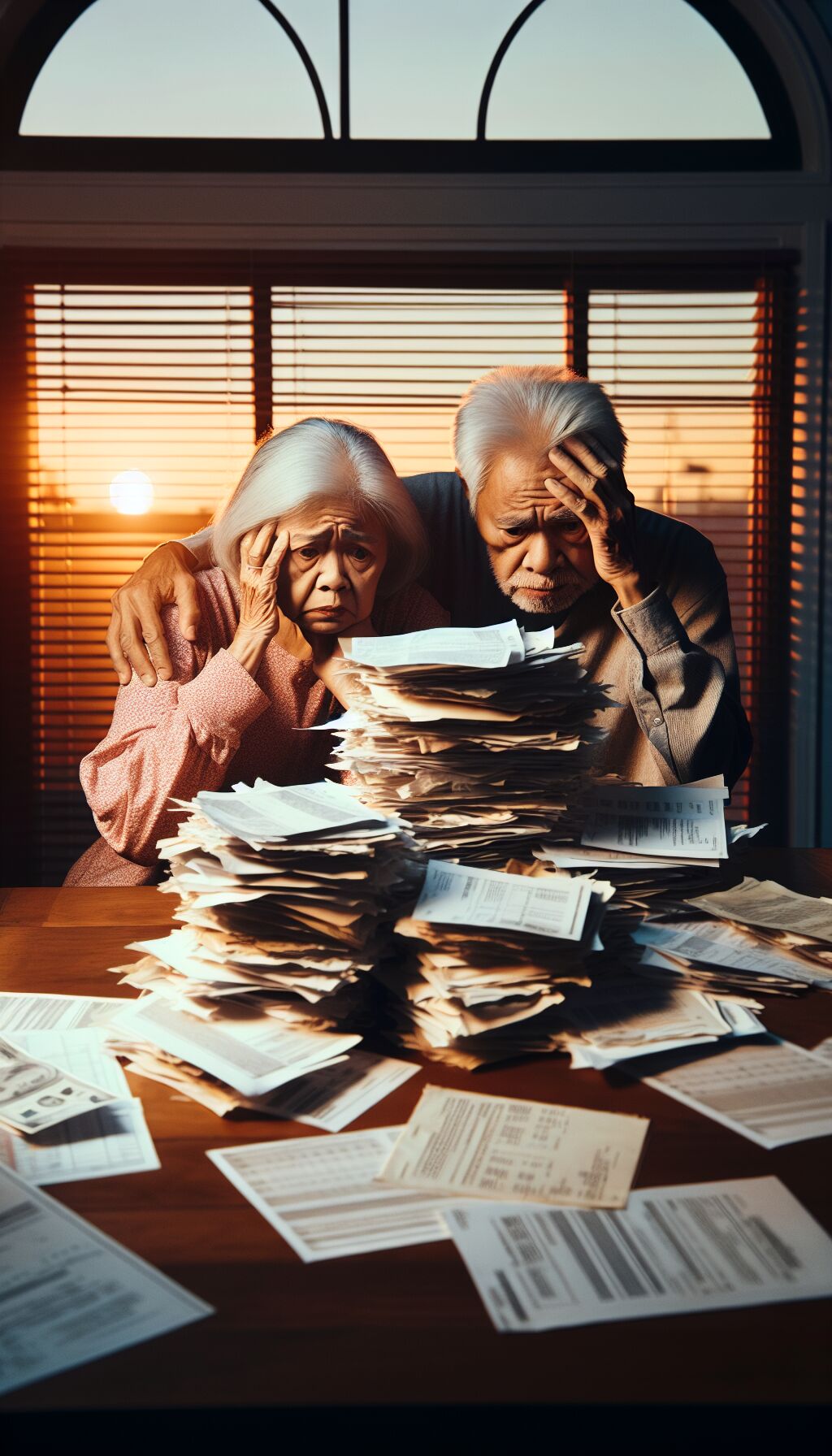

While longer mortgage terms present immediate affordability benefits, they also carry long-term risks that homeowners must consider. One of the most significant concerns is the potential for financial strain during retirement, as many borrowers could find themselves still making mortgage payments when they are no longer earning a steady income.

For these homeowners, the financial landscape could be drastically altered once they retire. Without a regular paycheck, managing monthly mortgage payments can lead to increased stress and anxiety. This concern is particularly pressing for individuals on fixed incomes, where any fluctuation in expenses could impact their ability to maintain their homes.

Real-World Consequences: Retirement and Debt

Several studies have highlighted the troubling correlation between housing debt and financial security in retirement. Homeownership has long been viewed as a cornerstone of financial stability. However, the growing trend of long-term mortgages can have the opposite effect.

Data from the Federal Reserve indicates that more Americans are carrying debt into retirement, and this burden is often compounded by mortgage obligations. As homeowners grapple with payments that extend into their later years, they risk compromising their ability to save adequately for retirement, thus affecting their overall financial health.

Moreover, the implications go beyond mere personal finance. The financial industry may also face broader consequences, as older homeowners struggling with mortgage payments might delay downsizing or selling their homes, further constraining the housing market and affecting its overall fluidity.

Preparing for the Future: Strategies for Borrowers

Given these realities, it is crucial for current and prospective homeowners to adopt informed strategies to navigate the longer mortgage term landscape. Financial literacy is key, and homeowners need to understand their options before committing to a mortgage.

One alternative is to consider shorter mortgage terms, even if this means facing higher monthly payments initially. While it might seem daunting, paying off a mortgage sooner can provide a clearer path to financial freedom in retirement.

Moreover, homeowners should explore refinancing options. As market conditions change, borrowers may find it advantageous to refinance to shorter terms or better interest rates as their financial situations evolve. Staying informed about market trends can help homeowners make timely decisions that align with their long-term goals.

Furthermore, developing a comprehensive retirement plan that accounts for ongoing mortgage payments can significantly mitigate risks. Partnering with a financial advisor to ensure adequate savings and investment strategies will prepare homeowners for a successful retirement.

A Call to Action: Policymaker Involvement

As the trend of extended mortgage terms gains traction, it is imperative for policymakers and industry stakeholders to address the potential implications. Raising awareness about the risks associated with long-term mortgages can help guide prospective homeowners toward more sustainable choices.

Moreover, financial literacy initiatives targeting younger generations can empower them to make informed decisions about their home financing options. Encouraging responsible lending practices that prioritize long-term affordability over merely facilitating access to credit can foster a healthier housing landscape.

Conclusion: Striking a Balance

The increasing prevalence of mortgages that stretch into retirement years poses significant challenges for homeowners and the housing market alike. As nearly 40% of new mortgages fall into this category, it is essential for individuals and policymakers to recognize the potential risks and find ways to foster responsible borrowing practices while encouraging homeownership.

By being proactive in understanding the implications of longer mortgage terms and advocating for financial literacy, current and future borrowers can work toward securing their financial futures—ensuring that homeownership remains a source of stability and not a burden.